Bad weather contributed to a drop in housing starts in December in Greater Sudbury, says an analysis this month from the Canada Mortgage and Housing Corporation.

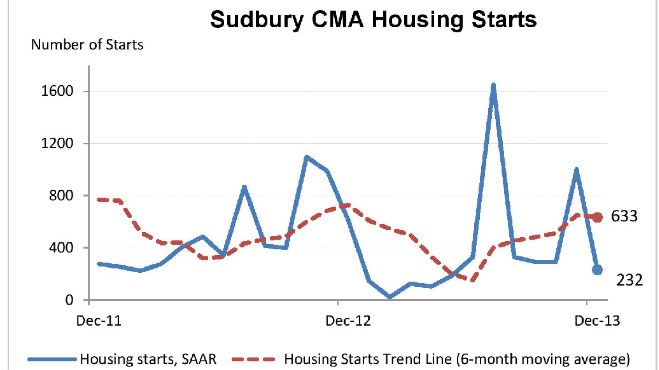

In a release, the CMHC said starts were “trending” at 633 units in December, compared to 649 in November. The trend is a six-month moving average of the monthly seasonally adjusted annual rates – or SAAR -- of housing starts. The number reflects how many houses would be built annually in Greater Sudbury if the trend for that month continued for the entire year.

The CMHC uses SAAR to give a more reflective picture of local housing markets. The seasonal adjustments incorporate historical and other factors to estimate trends, rather than raw month-to-month stats. Those figures tend to vary dramatically according to building season or factors such as extreme weather.

The raw numbers saw the trending statistic dip to 232 units in Sudbury last month, down from 1,000 in November. In real terms, construction began on 11 homes last month. While still reflecting an overall weakening in the local housing market, an analyst with the CMHC said the trend is far more gradual than the month-to-month stats would imply.

“Despite a significant decline in housing starts in Greater Sudbury as compared to same period last year, the start of 11 units in December helped maintain six-month moving average almost unchanged from November,” said Jawad Ahmad, CMHC's Market Analyst for Sudbury.

“(So) the early arrival of severe winter dampened already sluggish starts activity in Greater Sudbury.”

Ahmad said starts in the previous quarter in Sudbury were mainly family units, a type of housing that is “volatile” and prone to spikes and dips. But it was a sluggish year, he said, with total starts dipping to 427 compared to 536 in 2012.

“Overall, we see the starts are slower overall, there's no doubt about that, but he drop is mainly in single-detached, semi-detached and row houses,” he said. “But apartment construction is actually higher this year … It seems builders see a need in the rental market, and it seems a good time to invest.”

The seasonally adjusted rate for housing starts in the city has ranged from a high of 800 units in December 2011, to low of close to 200 units in July 2012. The market was weaker in most areas of Canada and Ontario last year, Ahmad said, with a few exceptions.

“If you look at Timmins and Sault Ste. Marie, the starts were actually higher this year,” he said.

But even in the areas where there was growth in construction, it was concentrated in rental units. Construction of single-family was down almost everywhere. Ahmad said it's likely a reflection of a growth in demand for rental units, with developers opting to delay construction of other types of housing for now.

“Demand is still there, and we see that in Sudbury, where employment levels are stable and average incomes are very close to the Ontario average,” he said. “Prices are still lower than the Ontario average, so there is still affordability.”

At the end of the third quarter in 2013, the average home price in Sudbury was $209,489, compared to $403,207 for all of Ontario. Average rent for two bedroom apartments in Sudbury last year increased by just more than one per cent to $925. The CMHC forecasts another modest rise to $930 in 2014.

Housing Market Facts:

-- The downward trend in existing home sales in Sudbury continued in 2013, but is forecast to regain momentum in 2014.

-- Greater Sudbury home prices grew by 3.3 per cent in 2013, but 2014 estimates are 1.3 per cent, as listings are expected to adjust to softer demand.

-- Following an 18 per cent drop in 2013, housing starts are forecast to rebound this year, with an overall increase of six per cent.

Source: The Canadian Mortgage and Housing Corporation